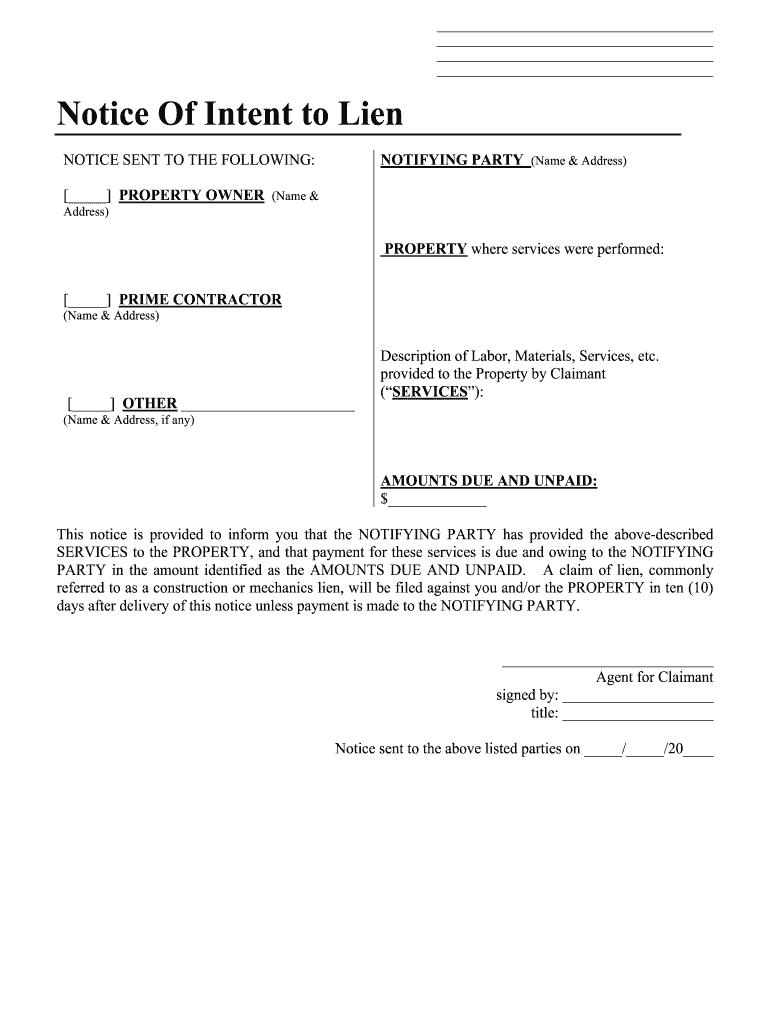

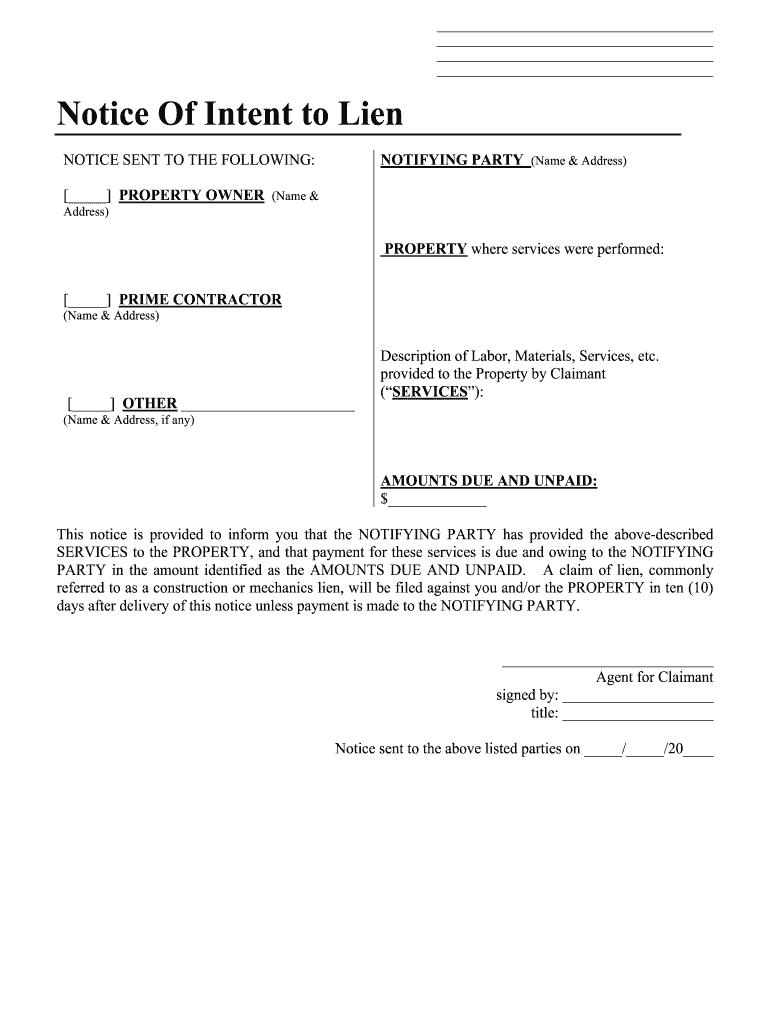

Get the free notice of intent to lien illinois pdf form

Get, Create, Make and Sign

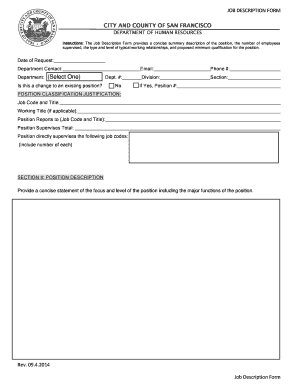

Editing notice of intent to lien illinois pdf online

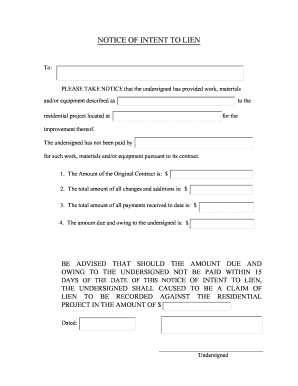

How to fill out notice of intent to

Who needs an Illinois lien?

Video instructions and help with filling out and completing notice of intent to lien illinois pdf

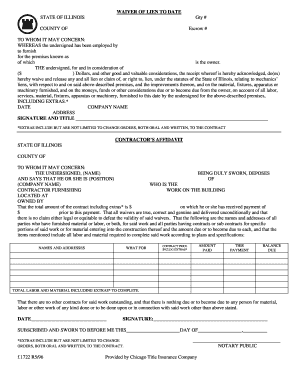

Instructions and Help about illinois mechanics lien release form

Tax liens and notice of federal tax lien don't ignore it because it won't go away facing up to your IRS tax debt is important because when the IRS comes knocking you'll need to be ready and being ready as an option for there are alternatives to being at the mercy of the federal tax collectors if you are behind with your taxes, and you probably know it you will also want to know that the IRS can make life very unpleasant for you mainly because if you find a tax lien being filed against you your credit rating will be instantly affected, and you will be given a bad name among other credit lenders having a tax lien against you could make it extremely difficult for you to get approved for any future credit amounts your prospects of attaining a new credit card might also be greatly reduced the other bad news is any creditors you have will receive automatic notification of your tax debt status which will only bring further complications for you unfortunately this could also affect your attempts to make big money purchases such as a car or home as this becomes virtually impossible with a bad credit score putting your name to any official documents involving financial obligations might also be affected these are the things you should know if you have a tax debt hanging over you but maybe what you don't know is there are ways to prevent the IRS clamping down hard on you because in some circumstances you may be able to escape penalty for late payment the best thing to do if you have an IRS tax debt demand is seek assistance from an attorney who can give you the expert advice and suggest your best course of action the law office of Thomas W Lynch and associates can help you get beyond the problems which are preventing you from moving forward to a promising future if you live in southwest suburban Chicago lands the law offices of Thomas w lynch and associates is particularly conveniently located for you, you can contact our office directly by calling 708 5985 999 or by visiting our website at WWW lynch PC calm the law office of Thomas w lynch our business is helping you

Fill notice of intent to lien : Try Risk Free

People Also Ask about notice of intent to lien illinois pdf

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your notice of intent to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.